IRA

News You Can Use

2024 Social Security COLA Set at 3.2% and What It Means The recently announced increase in the Social Security cost-of-living adjustment (COLA) for 2024 is much more modest than the one announced just a year ago. But milder or not, it has meaning. So what does it mean? The more modest increase reflects a slowing…

Read MoreBreaking News: IRS Grants Two-Year Delay in Roth Catch-Up Requirements

Section 603 of the SECURE 2.0 Act added a new requirement that high-income individuals must make their catch-up contributions on a Roth basis for high-income individuals, citing “high-income” as employees with wages exceeding $145,000 paid in the prior calendar year by the employer sponsoring the plan. Mandatory Roth treatment of catch-up contributions for high income…

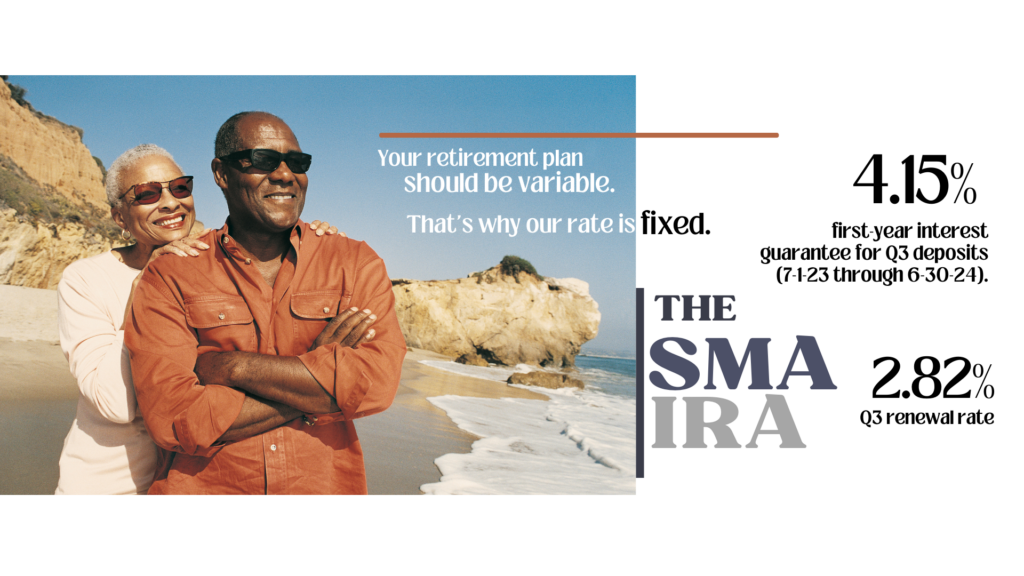

Read MoreNew SMA IRA Rates!

Tax-deferred, guaranteed savings at a great rate AND liquidity! No matter where you are in your life, things can change. It’s always important to save money. The trick is being able to earn interest on your savings, and have easy access to cash without having to pay steep penalties to get it when you need…

Read More